This is a sign not to ignore. The sound of a baby alligator bleating is a guarantee that Mama will be on the spot very soon. Please give the nests, baby gators and the shoreline of the ponds a wide berth at the Cocoa Beach Country Club.

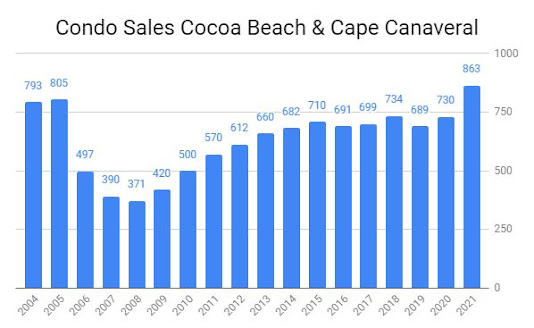

Inventory is increasing. There are 81 existing residential properties of all types for sale this morning in Cocoa Beach and Cape Canaveral at prices between $134,900 and $1,999,000 with a median asking price of $499,000. Thirteen of these are single family homes, all of them in Cocoa Beach. There hasn't been a single-family home offered in Cape Canaveral for several weeks.

There are still two luxury units offered in The Surf (under construction) downtown Cocoa Beach for $1.66MM and $1.999MM. Other listings of note are a remodeled 47 year old, 10th floor NE corner 2/2 at 2100 Towers asking a staggering $1,497,000. How about a 3rd floor 3/2 with 1323 square feet and no garage at Cocoa Beach Towers asking $950,000. Weekly rentals allowed here so that takes a small step towards justifying that number.

Twenty two residential listings have closed so far in May, including a yet-to-be-finished single family in a new riverfront development in south Cocoa Beach for $2,095,000. Not sure how they manage to close the sale of houses that have yet to be finished. Maybe someone can enlighten me. Over half of the closed sales sold for full asking price or more, one at $65,000 over asking price and over half sold within the first seven days on the market. And, over half of the closed sales sold for cash.

Other closed sales of note included a small furnished 1st floor Canaveral Towers 2/2 with no garage and no ocean view that sold for $595,000. Weekly rentals boosted that number as they did for a 49 year old, 2nd floor, side ocean view Spanish Main 2/2 that sold for $549,500. It was remodeled and furnished but had no garage. A nicely remodeled & furnished 3rd floor direct ocean 2/2 at Hacienda del Mar in south Cocoa Beach closed for $594,000. It has a wide open ocean view and a garage but the building doesn't allow weekly rentals.

Sales continue to be strong with 32 contracts accepted since May 1 including a penthouse at the unfinished Surf downtown Cocoa Beach that was listed for $3.2MM.

The national thirty year fixed rate mortgage average is 5.57% as reported today by Bankrate.com. That's two full percentage points higher than the rate we began the year with. This is certainly affecting some buyers but with a high percentage of cash sales and second home sales, the effect on our local market is not as drastic as it may be in non-vacation-destination markets.

Those looking to buy in our market will be well-served to remember that there is intense competition and many prices can't be justified by the last sale of a comparable property. The sales are going to the bold and quick buyers. The time to do one's homework as a buyer is before the search begins, not after a property has been found. While you're studying comps some other buyer is likely already writing a non-contingent offer. Know what you want and what you're willing to pay to get it. Be realistic. There are no deals in a market like this. Either make peace with that or stop torturing yourself with a search that isn't going to yield fruit. Best of luck to those of you on the hunt.

"If you add up all the federal and you look at the disability and the unemployment and the Social Security and the state, my tax rate's 62, 63 percent. So I've got to make some decisions on what I'm going to do." _Phil Mickelson